Carrying debt is stressful. Constant worry over your finances and juggling payment plans and debt collectors can drain your energy and make it difficult to enjoy life. If you are struggling to manage your debt or see your balance ballooning with interest even as you make payments, debt consolidation can help.

What Is Debt Consolidation?

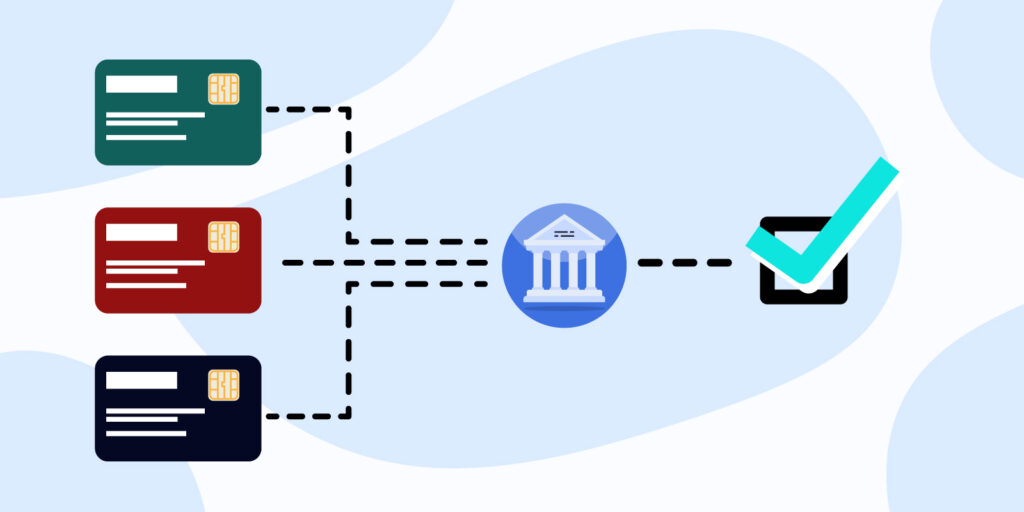

Debt consolidation is a way to take charge of your debt and manage it more effectively, with less strain on your budget. Instead of keeping track of multiple accounts, you combine your debts into one single account and set up a new monthly payment. This payment is typically lower and has a reduced interest rate compared to your prior loans.

A good debt consolidation plan can shorten your repayment period and make your monthly obligation more affordable. This means you can finally take back control over your finances and be debt-free in just a few years.

Best Ways to Consolidate Debt

Credit card debt is the type most often consolidated, but you can use the same tactics to tackle unpaid medical bills and occasionally even student loans. There’s no single solution to debt consolidation. A lot depends on your income, credit history, and credit score. Research your choices and weigh the pros and cons of the following methods to determine which one is best for your situation.

Debt Management Plan with Credit Counseling

Nonprofit debt management and credit counseling services review your financial situation and help you create a plan to pay down your debt and get your finances back on track. Credit counseling companies often negotiate a payment plan with your creditors on your behalf. Once a payment plan is established, you just make a single payment to the credit counseling organization, and they disperse it to your loans. Do some research to learn about any fees or restrictions on your credit usage before you commit to anything. You can find a reputable company by checking with the attorney general’s office in your state.

Credit Card Balance Transfer

Balance transfer credit cards let you move your existing balances from one (or several) credit cards to a new one. These cards often come with 0% APR for the introductory period. If you are able to pay off the balance before this period ends, a balance transfer credit card can save you a lot of money. This timeframe is often short, and your balance starts to collect interest once it’s over. If your new card has a high fee, you could be right back where you started.

Before you opt for a balance transfer credit card, learn the terms of the introductory APR period. Late or missed payments during this time can render the low APR offer invalid. You should also find out if there is a fee to transfer your balances.

Personal Loan

You need good credit to make taking out a personal loan worthwhile. The better credit you have, the more favorable loan terms you can expect. Borrowers with poor credit may face sky-high interest rates that make it difficult to make any headway paying down debt if you aren’t outright denied a loan.

If you qualify for a low-interest rate and flexible terms, a personal loan is worth considering. However, if you’ve made financial mistakes in the past, it’s often hard to find a lender willing to take a risk on you. Read the loan terms carefully. If the interest and fees are comparable to the rates you are already paying on your debt, it’s best to look for another option.

Tap Your Home Equity Loan

Homeowners that have equity built up can take out a home equity loan and use the cash to pay down debts. These types of loans often come with lower interest rates than personal loans or credit cards since you use your house as collateral. Proceed with caution when you take out a home equity loan. Defaulting on the loan puts your house at risk for foreclosure.

Peer-to-Peer Loans

An alternative to a typical personal loan is peer-to-peer lending. Lenders and borrowers are matched online, so you can avoid banks. The process is simple, easy, and often has low-interest rates and fees. You may need to shop around to find a lender that provides the amount you need. A credit score of at least 600 is also usually a requirement for approval.

Retirement Account Loan

Check with your employer to see if your retirement account has a loan option. This may help you qualify for lower interest rates if you can’t pass a credit check for traditional loans. Only use this option if you are sure you can repay the funds. Remember, this money is for your retirement. If you don’t repay it, the amount you withdrew could be taxed, or you could owe a penalty fee. Plus, any amount you take out of your account doesn’t earn you any interest.

Borrow from a Life Insurance Policy

Do you have a whole life insurance policy? You may be able to take out a loan equal to the cash value you have built up in the policy. The great part about borrowing from your own life insurance is that you have full control over when you take out the funds, the amount you borrow, and your repayment plans. As an added bonus, once you repay the loan in full, you can borrow from the policy again.

Cash-Out Auto Refinance

Another alternative is to check with your lender to find out if they offer a cash-out refinance option on auto loans. If so, you can use any equity you have built into your car to obtain a loan to use to pay off your debt. Never go this route if you aren’t certain you can make your payments. Failure to comply with the loan terms could result in losing your vehicle.

Borrowing from Family or Friends

Review your financial situation and the total amount of debt you owe. If you don’t owe a lot or have one or two high-interest credit cards that are causing you stress, you might want to ask for help from a friend or family member.

Borrowing from people you know gives you much greater flexibility and favorite interest terms. The downside is that borrowing from your friends or family can strain even a good relationship. Clearly outline the loan terms and stick to your agreed-upon repayment schedule just as you would if you took out a loan with a bank.

How to Choose the Best Option for You

Don’t get overwhelmed by all the choices when it comes to debt consolidation. Gather your information, do a little research, and select the option that gives you relief and peace of mind. You can narrow down your choices by seeing what you qualify for and eliminating options that make you uncomfortable, like risking your home as collateral with a home equity loan.

Make sure that you can afford your new monthly payment.

Going through the process to consolidate your debt won’t do you any good if you default on your new loan terms. Once you have your payment plan in place, educate yourself on good financial habits and budgeting. Taking steps to improve your spending and managing your finances properly lets you avoid future problems and work toward financial success.

You might also be interested in: Breaking Up Investments For Long-Term Success [3 Metrics To Measure]